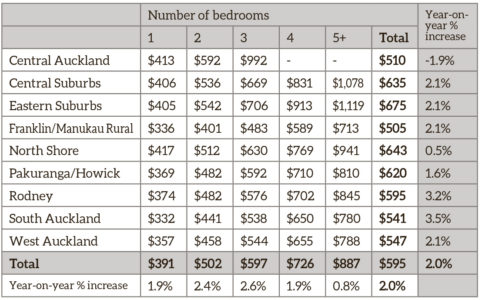

Quarterly Rental Update shows Auckland’s rental market ends year near $600 per week mark; weekly rents in most areas up $10 or more per week

The average weekly rent in Auckland reached a new high of $595 at the end of 2020, just shy of a long-anticipated $600 per week.

The figure is based on actual rents paid during December 2020 for around 16,500 Auckland properties, including both new and existing tenancies, managed by agency Barfoot & Thompson.

“We have long suspected the market would hit the $600 mark during 2020. And while this was dampened somewhat by the effects of lockdown, the momentum continued among newly signed tenancies,” said Barfoot & Thompson director Kiri Barfoot.

“Activity during this quarter was also not constrained by the rent freeze, which ended in late September, and we’ve seen a slight lift in average prices across the board.”

At $595, the average Auckland rent in December 2020 was up 2 per cent year-on-year.

This equates to around $12 more per week, or $624 more a year.

Barfoot said this also indicates a return to a more “normal” pace, being on par with December 2019’s increase of 2.1 per cent year-on-year, which also equated to around $12 more per week.

Three-bedroom homes, which make up the majority of Auckland’s rental stock and are typically used as a market benchmark, attracted rents of $597 per week in December 2020 ($15 or 2.6 per cent more than in December 2019).

Meanwhile, properties with five or more bedrooms were relatively static with less than one per cent movement, albeit still around $7 more per week than the same time last year.

The regions with the highest rates of increase were south Auckland and Rodney, up 3.5 and 3.2 per cent respectively – representing $18 per week rises.

Moving into the New Year, Barfoot said property managers are reporting increased activity and interest in listings, with high volumes of prospective tenants attending viewings.

“The number of available properties is fairly steady, however interest and competition for properties appears to be on the up.

“And while we are seeing some owners choosing to exit the market, we are also seeing an increase in the number of rental appraisal requests from new investors which is promising.”